App Tokens

What is an AppToken?

The AppToken object is an investment positions that are represented by a token

standard like ERC20. These are transferrable and fungible positions that maybe

considered as a receipt for an investment transaction with a Web3 app. These

receipts may be used to represent:

- Liquidity pool positions in a decentralized exchange like Uniswap, SushiSwap, or Curve

- Autocompounding "vaults" like in a yield aggregator like Pickle or Yearn

- Supply and borrow positions in a lending app like Aave

- Or even more obscure primitives like options in Opyn or prize savings accounts in PoolTogether

What is a TokenFetcher?

In the Zapper API, a TokenFetcher class provides the template to create a

group of AppToken objects.

Groups of tokens share common properties, most predominantly how their prices are derived from on-chain RPC calls, but also properties like APYs for Pickle vault tokens, or fees for Uniswap pool tokens.

As such, we declare unique strategy classes for each token group that we want to index in Zapper.

What are the properties of an app token?

The following table describes the properties on the AppToken object.

| Property | Example | Description |

|---|---|---|

type | ContractType.APP_TOKEN | Used to discriminate types, do not change. |

address | '0x028171bca77440897b824ca71d1c56cac55b68a3' | Address of the token |

network | Network.ETHEREUM | Network of the token |

key | See below | A unique and stable key for this token, used for aggregation purposes in Zapper. |

appId | 'aave-v2' | The token belongs to this app. |

groupId | 'supply' | The token belongs to this app group. |

symbol | 'aDAI' | The ERC20 symbol of this token |

decimals | 18 | The ERC20 decimals of this token |

supply | 438584072.834534305205134424 | The ERC20 supply of this token, denormalized to the number of decimals |

tokens | [daiToken] | The underlying token(s). For example, to mint aDAI tokens, you need to supply DAI tokens. |

price | 1 | The price of one unit of this token. In the case of aDAI, the tokens are minted 1:1, so the price is the same as the underlying DAI token. |

pricePerShare | 1 | The ratio between the price of the token and the price of the underlying token. Since aDAI and DAI are minted 1:1, the pricePerShare is 1. |

dataProps | See below. | Additional data props that might be useful to be passed in other areas of the application. For example, the liquidity data prop is used by Zapper to calculate the protocol's TVL. |

displayProps | See below. | Properties used by Zapper Web and Zapper Mobile to render meaningful information to Zapper users. |

What are data props?

The dataProps field on an AppTokenPosition object is used for augmenting the

token object with additional data properties. These properties can be used in

other places in the application.

Example: In Aave V2, the supply tokens like aDAI and aUSDC are

"receipt" tokens for deposits. We can augment the dataProps with a liquidity

property that represents the total amount in USD for that given deposit token.

Another part of the Zapper API aggregates the liquidity data property to

calculate the total TVL of Aave V2.

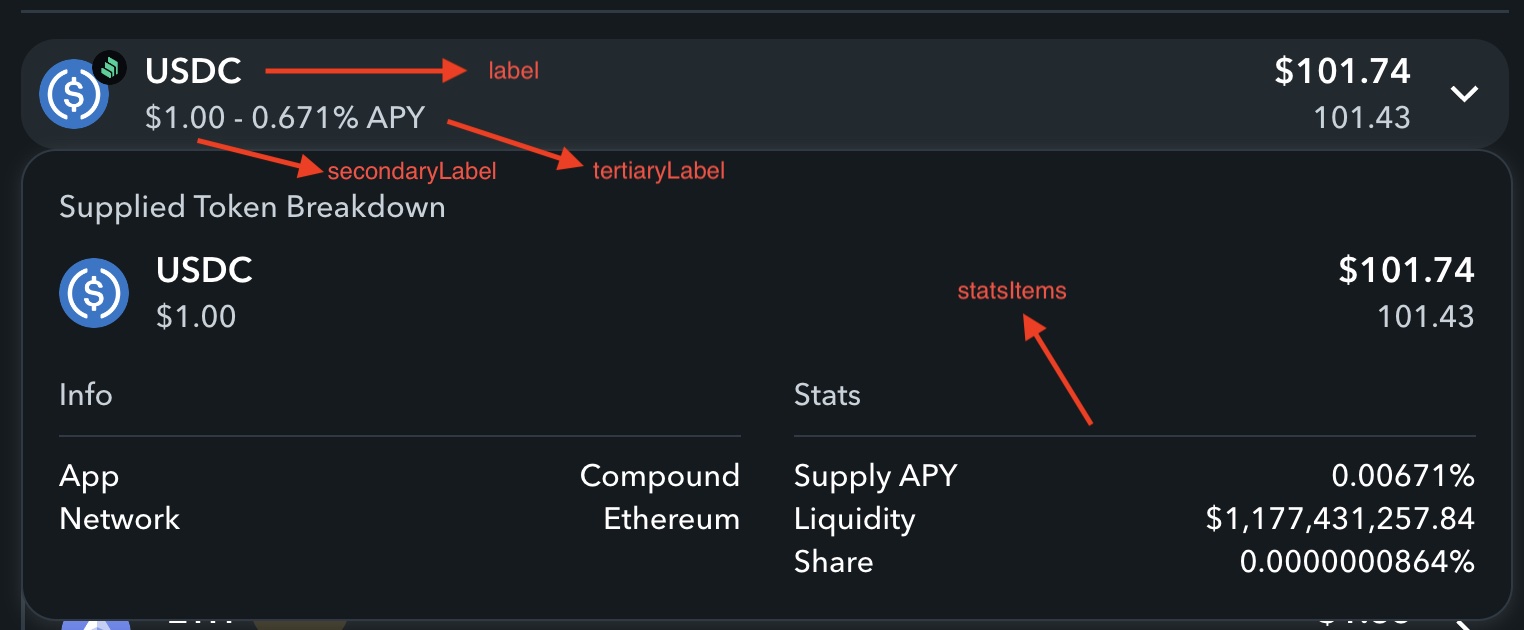

What are display props?

The displayProps field on an AppTokenPosition object is used by Zapper Web

and Zapper Mobile to render meaningful information to Zapper users about this

token.

| Property | Example | Description |

|---|---|---|

label | cUSDC | The primary label for this token. Token symbols are usually cryptic and technical, so choose a label that helps with readability for an average user. |

secondaryLabel | $1.00 | The secondary label for this token. Often, its useful to put the token price here. Use your best judgement here; for example, Uniswap V2 token prices are not very human readable, so its instead useful to put the reserve percentages here instead for those cases. |

tertiaryLabel | 0.671% APY | The tertiary label for this token. Most of the time, you don't need to use this field, but it could be useful to surface additional information to the user like an APY for a vault or lending token. |

statsItems | [] | An array of StatsItem objects that is rendered when expanding more details for the token. This field can include any additional information that is useful for the user in an expanded view. |

FAQ

What is pricePerShare? Why is it useful?

The pricePerShare field is the ratio between the token price and the prices of

the underlying tokens. This property is useful for using the balance of the

token to determine the exposure to the underlying tokens.

Example 1: In the case of Aave V2 supply tokens like aDAI, these are

minted 1:1 with the deposited token, DAI. As such, the price of aDAI is

the same as the price of DAI (about $1 USD), and so the pricePerShare is

also 1.

Example 2: In the case of Yearn vault tokens like yDAI, Yearn strategies

yield gains by accumulating more of the underlying vault token. The

pricePerShare increases over time as the strategies successfully farm yield.

At the time of writing, the pricePerShare for yDAI is about 1.12.

Example 3: In the case of Uniswap V2 pool tokens, the pricePerShare will

be an array of ratios, representing how much of each of the underlying token

corresponds to each pool token. We can use the pool reserves and the pool token

supply to calculate this as [reserve0 / supply, reserve1 / supply].

What is key? Why is it useful?

The key is a unique identifier on the token object that is used to aggregate

token balances across multiple addresses.

Usually, you can ignore setting the key and Zapper API will set the default as

md5(<app_id>:<address>:<network>).

In some circumstances, this is not a unique identifier, in which case, you can

add additional information via the positionKey data prop, which will then be

used to generate the key via md5(<app_id>:<address>:<network>:<position_key>).

Example 1: In Lyra, the protocol uses an ERC1155 contract for tokens

representing call and put options. The ERC1155 standard allows multiple token

fungible tokens through a single contract address. In this case, each option

token has an id field as an identifier. We'll return positionKey: tokenId in

the data props so that each ERC1155 app token position will have a unique key

as a result.